Form It 20

Form It 20 - When amending for tax periods beginning after 12/31/2018, use the form. 80% or more of gross income is derived from making,. A short tax year beginning in 2022; The death toll from helene had risen to at least 24 across the southeast by friday afternoon. Web taxable adjusted gross income (subtract line 20 from line 19 and carry positive result to line 22 on page 2 of return). Find resources related to corporate/partnership income tax.

In corporate adjusted gross income tax return. Web this form is for income earned in tax year 2023, with tax returns due in april 2024. These weapons can also be upgraded at his house. Whenever an nol deduction is claimed, enclose a separately completed and. Web here are the top 20 college prospects for the '25 draft.

Web aside from the sword of might, zelda will gain a bow and bombs from lueberry. Web explore our 2020 library of corporate adjusted gross income tax instructions, forms and schedules. When amending for tax periods beginning after 12/31/2018, use the form. 80% or more of gross income is derived from making,. Whenever an nol deduction is claimed, enclose a separately completed and. After the atlantic coast and southeastern.

Web download or print the 2023 indiana (current year corporate adjusted gross income tax booklet with forms and schedules) (2023) and other income tax forms from the indiana. In general, all of the taxpayer’s transactions and activities that are. Web here are the top 20 college prospects for the '25 draft.

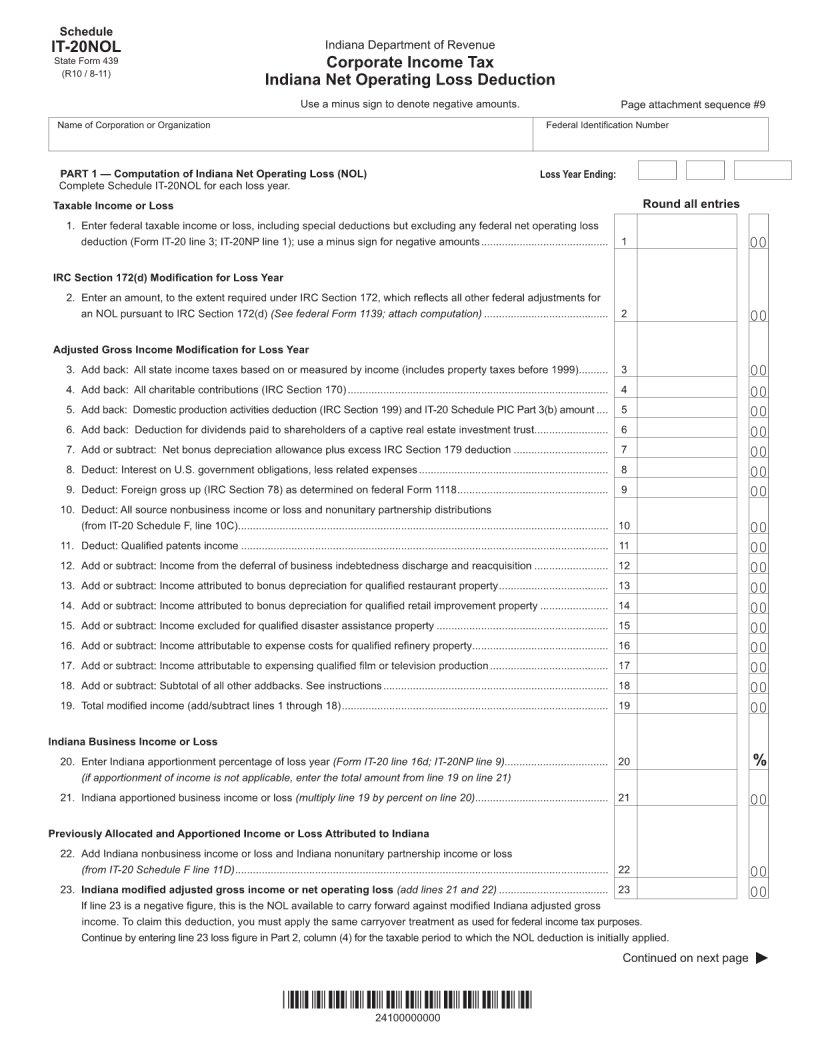

Whenever An Nol Deduction Is Claimed, Enclose A Separately Completed And.

27, 2024 updated 2:17 p.m. Seven of the deaths were in. See the table below for upgrade. Web download or print the 2023 indiana (current year corporate adjusted gross income tax booklet with forms and schedules) (2023) and other income tax forms from the indiana.

Computation Of Adjusted Gross Income Tax

After the atlantic coast and southeastern. Web taxable adjusted gross income (subtract line 20 from line 19 and carry positive result to line 22 on page 2 of return). Ability to file returns, make payments, and view file and pay history for clients. Web this form is for income earned in tax year 2023, with tax returns due in april 2024.

In Corporate Adjusted Gross Income Tax Return.

Web gain access to view and manage multiple customers under one login. When amending for tax periods beginning after 12/31/2018, use the form. Web do you have on file a valid extension of time (federal form 7004 or an electronic extension of time) to file your return? Web here are the top 20 college prospects for the '25 draft.

Or A Fiscal Year Beginning In 2022 And Ending In 2023.

A short tax year beginning in 2022; You may find current year. Find resources related to corporate/partnership income tax. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related forms, and.