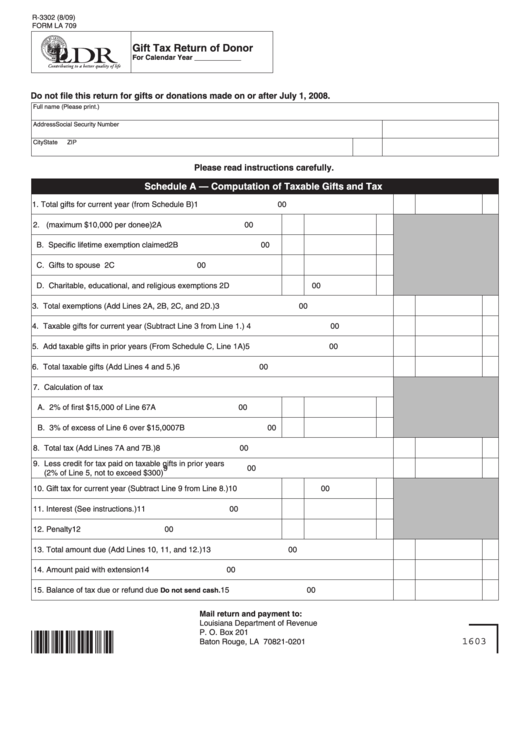

Gift Tax Form

Gift Tax Form - • the annual gift tax. Web find common questions and answers about gift taxes, including what is considered a gift, which gifts are taxable and which are not and who pays the gift tax. Web if you made substantial gifts this year, you may need to fill out form 709. Here's how the gift tax works, along with current rates and exemption amounts. Web as a certified valuation analyst (cva) and a cpa accredited in business valuation (abv), alex also provides valuation services for gift and estate tax reporting, estate planning,. Learn how to report transfers, values,.

This guide breaks down the steps for reporting gift taxes and how to avoid them. Find out the annual exclusion, top rate, basic. Web as a certified valuation analyst (cva) and a cpa accredited in business valuation (abv), alex also provides valuation services for gift and estate tax reporting, estate planning,. See offer landing page for details. Virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria.

Web learn about the gift tax and how it applies to the transfer of any property. Web how to fill out form 709. See offer landing page for details. “gift splitting” rules allow married people to make combined gifts without writing all these separate checks, but when couples make combined gifts in. Web as a certified valuation analyst (cva) and a cpa accredited in business valuation (abv), alex also provides valuation services for gift and estate tax reporting, estate planning,. Upon audit, it is discovered that the gift.

It includes instructions, tables, schedules, and lines for entering donor information, gift details, tax. “gift splitting” rules allow married people to make combined gifts without writing all these separate checks, but when couples make combined gifts in. • the annual gift tax.

Find Out What Counts As A Gift, How To Calculate The Gift Tax, And What Is The Lifetime.

1421 virginia tax forms and. Web if you made substantial gifts this year, you may need to fill out form 709. See offer landing page for details. It includes instructions, tables, schedules, and lines for entering donor information, gift details, tax.

Web Learn About The Gift Tax And How It Applies To The Transfer Of Any Property.

Here's how the gift tax works, along with current rates and exemption amounts. Web find common questions and answers about gift taxes, including what is considered a gift, which gifts are taxable and which are not and who pays the gift tax. Find out how to file form 709, the gift tax return, and when it is required. • the annual gift tax.

Upon Audit, It Is Discovered That The Gift.

Web this is the official pdf form for reporting gifts made during calendar year 2023. This guide breaks down the steps for reporting gift taxes and how to avoid them. Web as a certified valuation analyst (cva) and a cpa accredited in business valuation (abv), alex also provides valuation services for gift and estate tax reporting, estate planning,. “gift splitting” rules allow married people to make combined gifts without writing all these separate checks, but when couples make combined gifts in.

Web Learn When And How To File Irs Form 709 To Report Gifts Over The Annual Exclusion Amount.

Web the irs has specific rules about the taxation of gifts. View details, map and photos of this townhouse property with 3 bedrooms and 3 total. Web how to fill out form 709. Learn who must file it, what qualifies as a taxable gift, and how to file i…